Imagine you are approached with the following investments. So how do you evaluate them and how do you decide which one is good for you?

1. An insurance plan that returns more than 100% = RM138,401 after 20 years by putting in only RM63,054 staggered over the initial 5 years?

2. A GBP/RM Dual Currency Investment with a 10% enhanced yield? (1 week tenure, 5.38 strike price, 5.41 prevailing exchange rate)

3. Buying a share at RM1.60 when it was trading at RM3.20 yesterday before a unit split?

4. A highly diversified portfolio with historical returns of 7~8% per annum?

5. A property with guaranteed rental income of 10% for the first 5 years?

6. A Fixed Deposit placement of 4% interest rate?

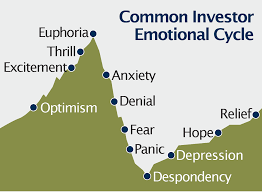

Most of us decide by experience, whether by trying a little bit of investments here and there and then top up later when the initial investments gives us some returns. When we got burned, we write off that particular option entirely, never to revisit it. We also rely on verbal anecdotes from our friends and families as to their own experience of investment returns. Emotions colour our investments, whether we realise it or not.

Think about how and why you select a particular investment from above. Think about the emotions behind the decision. When questioned, most peoples’ answer is always the same, whether a particular investment cheat people and make them lose money or they don’t take risk, they only go for the things they are familiar with. We talk as if investment is an emotional problem with an emotional solution.

For every person that do well in property, we will find another person who did poorly in it. And for every person who did well in stocks, we will also find another person who did poorly in it. So who is telling the truth? What is the real story here?

Instead of emotions, shouldn’t we think about the real fundamentals behind each investment?

How an insurance plan is able to give the returns stated?

Why can a Dual Currency Investment afford to give a 10% yield?

Why do public listed companies perform a unit split exercise?

Why is 7~8% reasonable/unreasonable for a diversified portfolio?

Why guaranteed rental income is given by property companies?

Does a 4% FD interest cover our own personal inflation rate?

If we do not know the answers, we must look for someone who do. There is an answer to the questions and it is purely scientific. There are historical data and there are reasons behind every offer. Even not accepting an offer has consequences for us, whether we like it or not. Thinking that we choose option 6 and ‘do nothing’ IS in fact a decision to gamble with inflation, which for most of us is a decision made unknowningly.

For advance practitioners, here are the answers to the above question:

1. IRR = 4.72%.

2. IRR = 10%, provided each and every trade over 52 weeks of the year is correct.

(A sample of how Dual Currency Investment works: http://www.uob.com.sg/wealthbanking/products/short_term_investments/maxiyield.html)

3. IRR = 0%, unit split will halve the trading value of a share by doubling the shares outstanding.

(This may look simple but apparently is major source of complaint to SIDREC as buyers thought they were buying a bargain.)

4. IRR = 7~8%, provided future returns equalized historical returns

(A reading on diversified portfolio here: http://www.schroders.com/en/insights/economics/13-years-of-returns-historys-lesson-for-investors/)

5. IRR = 10% + capital appreciation for the first 5 years but likely future rental return past the initial 5 years will be lower than 10%. Also capital appreciation depends on location, location, location.

6. IRR = 4%.